does kansas have estate tax

In most states it is set at a rate for every 500 of property value. The top estate tax rate is 16 percent exemption threshold.

Kansas Inheritance Laws What You Should Know

I would file a Kansas estate tax return if there are assets that would benefit from a step up in basis like real property or investments.

. As of 2013 estates in Kansas are not subject to a state-level estate tax. However if you are inheriting property from another state. States That Have Repealed Their Estate Taxes.

The Ohio estate tax was repealed as of January 1 2013 under Ohio budget laws. However if you are inheriting property from another state that state may have an estate tax that applies. Kansas began to phase out its estate tax in 2008 and completely eliminated the tax in 2010.

Like most states Kansas has a progressive income tax with tax rates ranging from 310 to 570. There is no estate tax in Kansas. State estate taxes were abolished by legislative action on January 1 2010 in Kansas and Oklahoma.

Married Americans should know that the federal estate tax that applies to them is the tax on combined marital estates worth over 2236. Kansas does not have an estate or inheritance tax. The federal estate tax applies to all estates in the United States of America that have a valued of slightly over eleven million dollars and are owned by a single person.

We have already discussed the fact that Kansas does not have an estate tax gift tax or inheritance tax. Updated December 21st 2021. Kansas does not have an estate tax or inheritance tax but there are other state inheritance laws of which you should be aware.

With a property tax rate of 137compared to a national average of 107you stand to be hit with a hefty property tax bill every year. The median home value in the state is slightly below the example above but at 139200 your property tax bill would still come out to about 1952 for the year. Kansas does not have an estate tax or inheritance tax but there are other state inheritance laws of which you should be aware.

The state sales tax rate is 65. State estate taxes were abolished by legislative action on January 1 2010 in Kansas and Oklahoma. Sorry for the confusion.

That means the annual tax on a 194000 home is 2713 per year. Massachusetts and oregon have the lowest exemption levels at 1 million and connecticut has the highest exemption level at 71. Kansas does not have an estate tax or inheritance tax but there are other state inheritance laws of which you should be aware.

Seven states have repealed their estate taxes since 2010. What is capital gains tax on real estate in Kansas. Kansas does not have an inheritance tax.

There are also local taxes up to 1 which will vary depending on region. Kansas has a property tax rate 140. How are cars taxed in Kansas.

States including kansas do not have estate or inheritance taxes in place as of 2013. We have already discussed the fact that kansas does not have an estate tax gift tax or inheritance tax. But this can vary greatly from area to area in Kansas.

Real estate transfer fees used to be complex in Kansas but have recently been reformed to make the process much simpler and easier to figure out. Property is cheap in Kansas with an average house price of 159400 so your annual liability is at least kept to a median of 2235. You may also need to file some taxes on behalf of the deceased.

The first source I looked at was incorrect. In addition to taxes car purchases in Kansas may be subject to other fees like registration title and plate fees. Twelve states and the district of columbia impose an estate tax while six states have an inheritance tax.

This guide walks Kansans who are starting to think about estate planning through what they need to know to protect their legacy after they pass. Kansas does not have an estate tax or inheritance tax but there are other state inheritance laws of which you should be aware. In Kansas it is set at 026 for every 100 or 026.

The new process is based on the number of pages in the mortgage or deed. Delaware repealed its tax as of January 1 2018. However if you are inheriting property from another state that state may have an estate tax that applies.

There wont be a tax to pay but the reported increases in asset bases will be valuable when the beneficiaries sell the assets in. Kansas Estate Tax Kansas maintained an estate tax similar to. Kansas collects a 73 to 8775 state sales tax rate on the purchase of all vehicles.

Does Kansas have high property taxes. Kansas is one of the thirty-eight states that does not collect estate tax. In addition to the federal estate tax with a top rate of 40 percent some states levy an additional estate or inheritance tax.

Kansas Sales Tax on Car Purchases. There is a federal estate tax that may apply. Kansas Real Estate Transfer Taxes.

Kansas does not collect an estate tax or an inheritance tax. Kansas does not have an estate tax but residents of the Sunflower State may have to pay a federal estate tax if their estate is of sufficient size. Many cities and counties impose their own sales tax bring the overall rate to between 85 and 9.

In most states it is set at a rate for every 500 of property value.

New Stimulus Package May Be Introduced Next Week Estate Tax Types Of Trusts Senate

Kansas Inheritance Laws What You Should Know

Those Who Have A Better Grasp Of Tax Technicalities And Opportunities For Economic Growth Will Always View Estat Estate Planning Florida Real Estate Estate Tax

States With No Estate Tax Or Inheritance Tax Plan Where You Die

States That Offer The Biggest Tax Relief For Retirees Best Places To Retire Retirement Locations Map

Property Tax Kansas County Treasurers Association

Kansas Estate Tax Everything You Need To Know Smartasset

The End Of The Year Is Approaching Please Consider The Many Ways You Can Enjoy Tax And Income Benefits While Also Helping State University Enjoyment Income

The Ultimate Guide To Kansas Real Estate Taxes

Kansas State Economic Profile Rich States Poor States

Pin On Finances Save Money Today

Kiplinger Tax Map Retirement Tax Income Tax

Which Counties Pay The Most Taxes In Kansas You Ve Probably Guessed Correctly Wichita Business Journal

Kansas Estate Tax Everything You Need To Know Smartasset

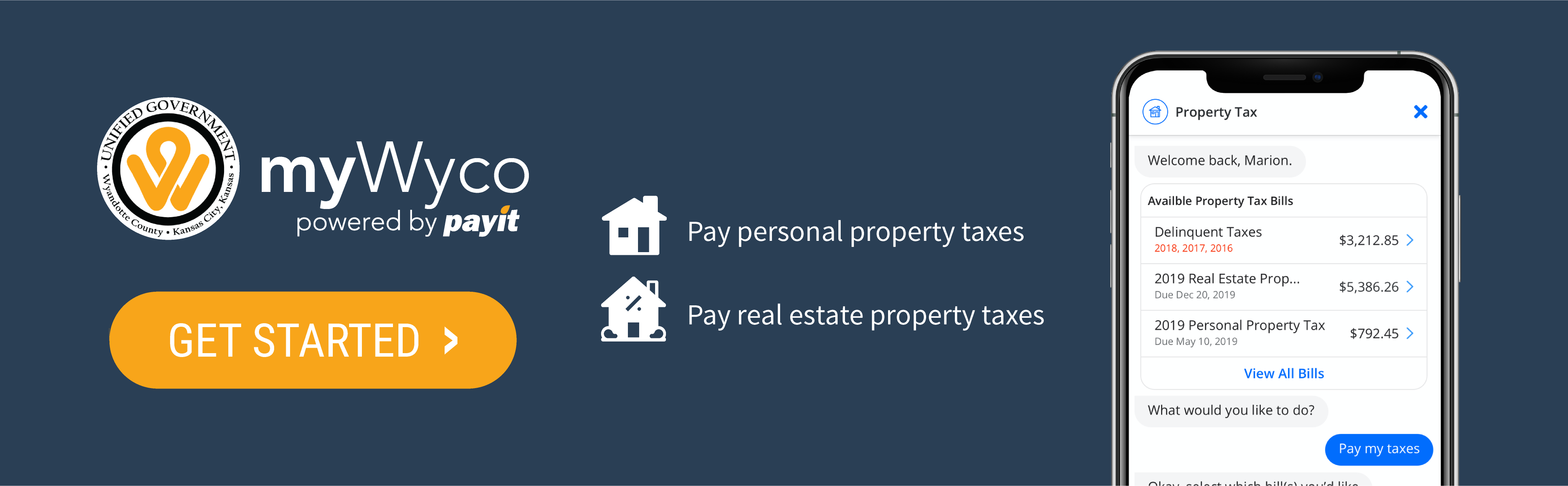

Real Estate And Personal Property Tax Unified Government Of Wyandotte County And Kansas City

Kansas Inheritance Laws What You Should Know

Kansas Estate Tax Everything You Need To Know Smartasset

How New Kansas Laws Affect What You Pay In Property Taxes

What Is A Homestead Exemption Protecting The Value Of Your Home Homesteading What Is Homestead Property Tax